When it comes to credit scores, the lowest credit score possible isn't the score you want to be aiming for, but help avoid it, it's still good to understand what it is. After all, your credit score plays a significant role in determining your financial health and the opportunities that are available to you in the UK.

In this insight, we explore what a low credit score means, the potential consequences, and how you can improve it.

The lowest credit score possible is 0 using Experian's model. This score is considered very poor and a significant risk in terms of creditworthiness. It's important to strive for higher credit scores to improve your financial standing.

When considering Credit Scoring, having the lowest credit score means you have the weakest financial standing. It shows that you've had problems with repaying debts or managing your finances. With a low score, it's hard to get loans or credit cards from regular lenders. If you do get approved, you'll likely face high interest rates, strict rules, and low credit limits. To improve your credit score, you need to fix your financial problems and show that you can handle money responsibly. That way, you can qualify for better credit options in the future.

The lowest credit score for a credit card is 660 with a mainstream credit card company. However, there are specialist credit card companies that offer credit cards to people with lower credit scores.

Credit scores typically range from 0 to 1000, with 1000 being the highest achievable score. The lowest credit score within this range is 0. However, it is important to note that very few individuals have a credit score that low. In general, a credit score below 580 is considered "very poor," indicating a higher risk for lenders.

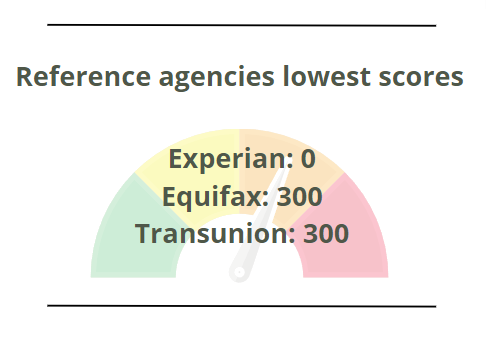

The lowest credit score possible varies by credit reporting agency. Here are the lowest scores used by the major agencies:

It's important to note that these scores represent the lowest possible range within each agency's scoring system.

Having a low credit score can significantly impact your financial life. Lenders use credit scores to evaluate your creditworthiness and determine whether they should extend credit to you. A low credit score may result in the following consequences:

It becomes tough to qualify for credit cards, loans, or other forms of credit. Lenders see you as a risky borrower.

If you do get approved, you'll likely face higher interest rates and extra fees. Lenders charge more to offset the risk. That could be in terms of interest rates or the need to put down a larger deposit.

Your options for mortgages, renting apartments, or getting insurance may be limited. Starting a business or accessing financing becomes harder.

Renting or buying a home can be difficult. Landlords and mortgage lenders check credit scores and may reject you or require higher deposits.

Some employers check credit scores, especially for jobs involving money. A low score can hurt your chances of getting certain jobs.

Improving your credit score is important for your financial well-being. Here are the key factors that affect your score:

Pay your bills on time to show responsible payment habits. Rule number 1. Missing payments is the most likely cause of bad credit. This includes mobile phone bills, which are normally the first line of credit available for us.

It is common advice to try to keep your credit card balances below 30% of your available credit, if you have a credit card limit of £1200, try to avoid leaving £400 or more on there, instead pay some back, increase your limit, or consider a balance transfer to another card you already have.

The longer you have your accounts running well, the more positive credit history you will build over time. Quite simply, a 20-year old who has just opened their first credit card will have a lower credit score than a 60-year old who has used credit cards without issues throughout their life, always managing to repay before the bill is due. It takes time.

Be selective and avoid applying for too much credit at once. If you have applied for many credit cards around a similar sign, it can show signs of desperation for credit and this can reduce your credit score. It's best practice to try to stick to one credit card. This is advantageous also as it can often mean you start to build points with your spending. As covered in our insight, does switching banks affect credit score? Anytime you open new credit you can expect at least a temporary drop in your credit score.

To avoid having the lowest credit score, here are some strategies to help you get started:

Consistently paying your bills on time is one of the most effective ways to improve your credit score. Set up automatic payments or reminders to ensure you never miss a due date. Even a single missed payment can have a negative impact on your credit score.

Lowering your credit card balances can positively impact your credit utilisation ratio. Aim to keep your balances below 30% of your available credit limit. Consider paying more than the minimum payment each month to accelerate debt repayment.

Regularly review your credit report from each of the major credit reporting agencies - Experian, Equifax, and TransUnion. Look for any errors, such as incorrect account information or fraudulent activity. Dispute and correct any inaccuracies promptly.

Avoid applying for multiple new credit accounts within a short period. Each credit application can result in a hard search on your credit report, which can temporarily lower your score. Be selective and only apply for credit when necessary.

Having a mix of different types of credit can positively impact your credit score. Consider diversifying your credit portfolio by responsibly managing different forms of credit, such as credit cards, loans, and mortgages. However, this does mean specifically going out of your way to open these accounts as that could negatively impact your score.

To obtain your multi-agency credit report from Checkmyfile, you can take advantage of their 30-day free trial. During this trial period, you can explore your credit information from all four major credit reference agencies without incurring any charges.

After the trial period, Checkmyfile charges a monthly fee of £14.99. However, you have the flexibility to cancel your account at any time if you choose not to continue using their services beyond the free trial.

In conclusion, having a low credit score can have a large impact on your financial life. It may limit your access to credit, result in higher interest rates and fees, restrict your financial opportunities, and even impact your housing and employment prospects. However, by understanding the factors that influence your credit score and taking proactive steps to improve it, you can avoid having the lowest credit score.

Find out how you can check your credit score for free here

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.